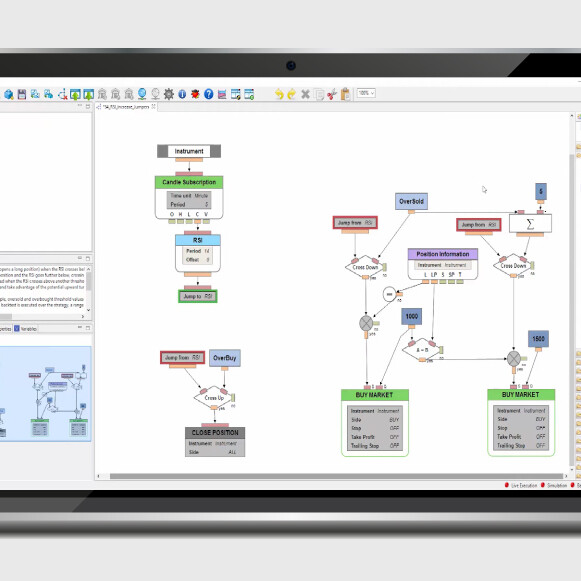

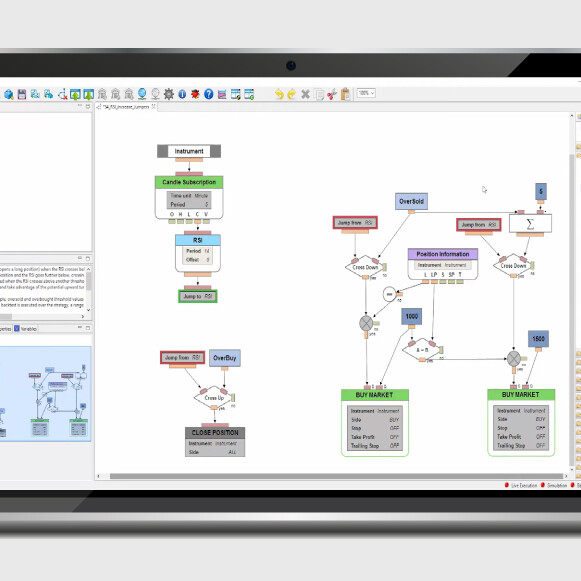

Bitcoin futures have just launched on Cboe Futures Exchange, LLC (CFE) and CME Group… and they are available for trading on QCAID. The new futures contracts will provide exposure to bitcoin without having to keep units of this popular cryptocurrency.

In addition, this launching will also provide greater transparency and an increase in liquidity, allowing traders to have wider access to pricing data and to manage their position risk. The bitcoin as an asset will also benefit from this participation in a highly-regulated market.

“At launch, our new Bitcoin futures contract will be subject to a variety of risk management tools, including an initial margin of 35 percent, position and intraday price limits, and a number of other risk and credit controls that CME Group offers on all of its products”, said Terry Duffy, CME Group Chairman and CEO.

The new instrument “provides a centralized marketplace for participants to trade based on their view of bitcoin prices, gain exposure to bitcoin prices or hedge their existing bitcoin positions”, according to Cboe.

The effect of the new instruments

The main concern about Bitcoin is its volatility, since the value of the cryptocurrency reacts strongly to sensitive market news and to the confidence in the asset itself. Although these fluctuations have tended to decrease, some experts remain cautious about its stability. Now futures contracts could contribute to reduce volatility, thus increasing market efficiency.

Bitcoin exchanges are the main marketplace for this cryptocurrency, although they are not the only one, as investments in Bitcoin are on the rise. That’s why some major banks and funds have warned about the effects that a potential bubble could have. Even the US Securities and Exchange Commission Chairman Jay Clayton has advised investors to “exercise extreme caution and be aware of the risk”. And Federal Reserve Chair Janet Yellen called the digital currency a “highly speculative asset”.

Despite all this buzz around Bitcoin, blockchain technology, the public ledger of cryptocurrency transactions, seems to be here to stay. The French Government, for instance, plans to allow the trading of some non-listed securities using the blockchain technology. This may help cryptocurrencies to prove that they are not a fad.

You can find the Bitcoin futures on QCAID with the new tickers F.US.XBT and F.US.BTC

CFE BitCoin

- Ticker: F.US.XBT

- Exchange: CBOE Exchange Futures

- Description: Cash-settled futures contracts based on the Gemini Exchange auction price for bitcoin in U.S. dollars.

- Contract unit equal to 1 bitcoin.

- Tradable since December 11th

CME BitCoin

- Ticker: F.US.BTC

- Exchange: CME on GLOBEX

- Description: Cash-settled futures contracts based on the CME CF Bitcoin Reference Rate.

- Contract unit equal to 5 bitcoins.

- Tradable since December 18th